Techweek rolled through Chicago last week, and I had the pleasure of speaking on behalf of Pangea Money Transfer as part of the “Finance with Impact” panel. The panel included passionate entrepreneurs and progressive bankers all dedicated to improving customers’ financial health while also driving shareholder value.

At Pangea, combining Fintech and social impact is nothing new—we live and breathe this every day. To paraphrase a line from my fellow panelist Tricia Martinez, co-founder and CEO of Wala, “We almost don’t think about social impact since it is so embedded in the company and product.” Still, panels like this serve as opportunities to reflect and hear how others are thinking about financial technology, startups versus banks, and—most importantly—how to bring value to customers.

From the panel and surrounding conversations, I had three major takeaways:

1. To be(come) an elite institution, social impact is not optional.

Whether you want to blame it on millennials, the parents who spawned them, or technologists, this generation of entrepreneur craves purpose and has alternatives. From engineers to marketing gurus, tech talent wants to do more than make a good wage—they want to make an impact. Some may wave their hands at the soft stuff like social impact, but to attract, retain, and motivate talented people with interesting alternatives, the work has to have a greater purpose. If you’re making a bet on a technology company, whether it’s by joining, partnering with, or investing in one, you can no longer ignore that the best talent is gravitating to companies that are solving real problems.

2. User experience is everything (at least in Fintech).

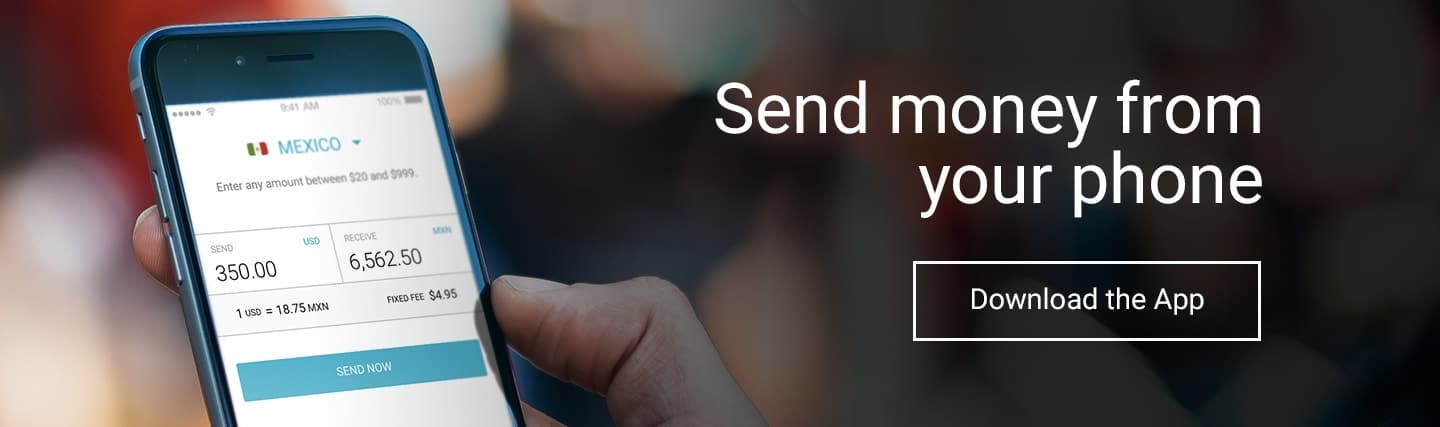

When you talk about Fintech and payments all day long, it’s easy to forget that customers find this stuff incredibly boring. Technology is pulling each of us in a million directions and customers want to spend time with their community, not wrestling with an app. Advancements such as machine learning, new payment rails, and alternative exchange rate schemes are all meaningful technological innovations, but none of that matters if a clunky user experience fails to keep a customer’s attention.

At Pangea, our customers care about getting money to their loved ones, not about the technology that makes it happen. Innovation in Fintech means putting together the puzzle pieces of the payments ecosystem so that the customer doesn’t have to.

3. Social impact in Fintech is about more than cost savings.

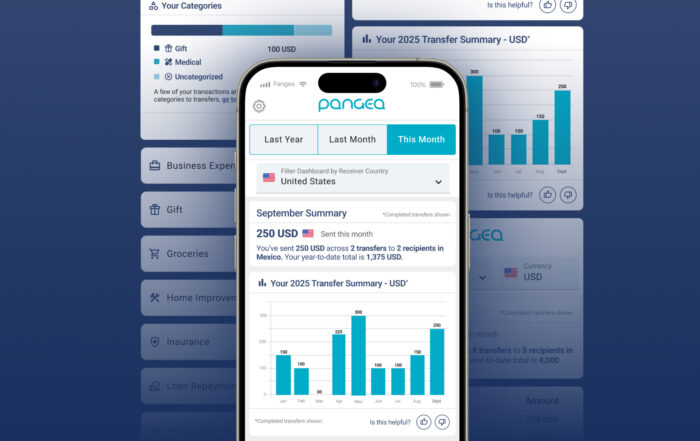

Innovation in any industry means driving down costs and improving functionality. To have a greater social impact, Fintech companies must improve customers’ overall financial health. This can come in the form of time savings, education, budgeting tools, tracking tools, additional financial controls, optionality, and much more. The Fintech companies focused on making a social impact understand their customers’ holistic situation, and create meaningful, customer-centric value-adds that improve the customers’ financial situations and control over other aspects of their lives.

Overall, the panel was a great opportunity to reconnect with the ever-growing and vibrant Chicago Fintech community, and, if only for a few hours, reflect on what we’ve built at Pangea and how we can continue to drive real social impact for our customers.